More FIX on the NET @ FIX University Cultural Campus

Welcome to Spring Semester 2013

Indonesia’s two largest airline groups, Garuda Indonesia and Lion Air, are further accelerating the expansion of their fleets as they look to capitalise on their leading positions in one of the world’s biggest emerging markets.

The two groups – which include Garuda budget carrier Citilink, Lion Air regional subsidiary Wings Air and soon Lion Air’s new full service unit Space Jet – are now committed to at least triple the size of their combined fleets from the current figure of about 180 aircraft.

Other Indonesian carriers, including Indonesia AirAsia, Batavia, Mandala and Sriwijaya, are also expected to rapidly grow their fleets as the total number of commercial aircraft operating in Indonesia could approach 1000 aircraft towards the end of the next decade.

The chiefs of several Indonesian carriers, including Garuda, Citlink and Lion, are attending this week’s Singapore Airshow and are attracting attention from suppliers of all types. On 14-Feb-2012, the opening day of the airshow, Lion finalised its landmark deal for 230 additional Boeing 737s. Lion, led by founder and president director Rusdi Kirana, will be wheeling and dealing at the airshow all week and is expected to sign on 16-Feb at a major follow-on order for additional ATR 72s. The orders will ensure the Lion Air group has a fleet of at least 468 commercial aircraft by 2026, including about 60 aircraft at Wings Air and about 60 aircraft at Space Jet (excludes Space Jet’s fleet of business jets).

Garuda plans to ink at the Singapore Airshow on 15-Feb its long-anticipated deal for 18 Bombardier CRJ1000s, which will be delivered in the short to medium term including five aircraft late this year. Garuda and Citilink are also using the airshow to negotiate potential deals for additional aircraft.

Garuda CEO Emirsyah Satar tells CAPA the carrier is seeking to acquire through leases or new orders additional A330s and 737s for delivery in the short to medium term. Garuda is also now talking to both Airbus and Boeing about a potential order for A320neos or 737 MAXs to meet its long-term requirement. Garuda, which currently has a fleet of just over 80 aircraft, expects to double its fleet over the next five years.

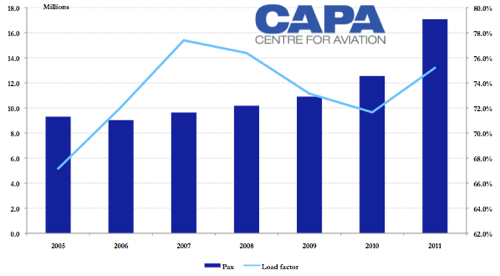

Garuda Indonesia Group passenger numbers and load factor: 2005 to 2011

Citilink to add 11 A320s this year

Citilink, which is currently a division of Garuda but will become a separate subsidiary with its own Air Operator’s Certificate (AOC) in April, is also talking to Airbus and leasing companies about additional A320s. Citilink now only operates nine aircraft – five 737-300s, one 737-400 and three leased Airbus A320s – but at the 2011 Paris Air Show last June placed orders for 15 A320s for delivery from 2014 and 10 A320neos for delivery from 2017.

See related article: Paris 2011: Indonesia takes centre stage

Citilink VP Con Korfiatis tells CAPA the carrier is also now committed to leasing 11 A320s for delivery in 2012 and eight A320s for delivery in 2013. Mr Korfiatis says the carrier is now seeking leases for another four to six A320s in 2013 as it aims to take delivery of one A320 per month as part of a goal to operate 50 A320s by the end of 2015. Mr Korfiatis says it is also “a good possibility” that Citilink’s options for 25 additional A320neos will be exercised to meet the carrier’s long-term growth requirement, although such a decision will not have to be made in the near-term.

Indonesia’s domestic market expected to double in size over next five years

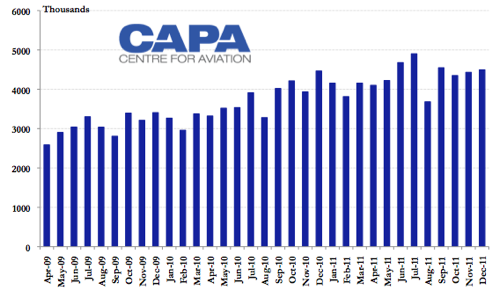

Indonesia has emerged as one of the world’s hottest aviation markets as the combination of a booming economy and a gigantic population with expanding discretionary incomes is projected to drive rapid growth over the next several years. Indonesia’s domestic market grew 18% in 2011 to 51.5 million passengers but is still relatively small given Indonesia is a country of about 240 million people with a geography in which air travel is a necessity. About two-thirds of Indonesia’s domestic passengers now fly on over-water routes between islands, meaning airlines only have to compete with buses and trains in one one-third of the market.

Domestic travel in Indonesia has grown at an average annual clip of about 20% in recent years and is expected to continue growing at a similar pace. Indonesia’s carriers are confident the domestic market will reach 100 million passengers in 2015 or 2016.

Indonesia monthly domestic traffic (thousands of passengers): Apr-2009 to Dec-2011

Lion Air says it flew a market leading 27 million passengers in 2011, nearly all of which were transported domestically (according to current Innovata data, only 6% of Lion’s seats are currently allocated to international routes). Mr Kirana expects the group will be transporting an average of 100,000 passengers per day by the end of this year, up from 85,000 passengers currently.

Lion Air goal of 60% market share seems unrealistic

Lion Air says it currently has a 51% share of Indonesia’s domestic market (includes Wings Air). Mr Kirana says the group’s order book ensures it can keep up with the anticipated rapid growth in the domestic market and will allow it to achieve its goal of reaching 60% market share within five years.

Such a goal seems implausible, however, when factoring in the plans of Lion Air’s archrival Garuda. The flag carrier’s full-service operation transported 12.2 million domestic passengers in 2011, giving it a 24% share of Indonesia’s domestic market and representing 40% growth over 2010. Mr Satar expects Garuda will continue to grow its mainline domestic operation over the next few years at a faster clip than the overall market. He is also confident the Garuda-branded domestic operation will not be impacted by Citilink’s expansion (all of Citilink’s routes are also operated by Garuda but the two carriers focus on different segments of the market).

Mr Satar says this year Garuda will only be expanding its mainline fleet by a net of seven aircraft, including two widebodies and five regional jets as the new 737s being delivered will simply replace 737 Classics. But higher aircraft utilisation of its existing fleet will allow Garuda to expand capacity domestically and internationally at only “slightly lower” rates than 2011, when Gardua recorded 34% mainline domestic ASK growth and 20% international ASK growth.

Citilink’s domestic market share could near 20% by 2015

Citilink transported 1.6 million passengers in 2011, representing 42% growth over 2010 but only giving the LCC a 3% share of Indonesia’s domestic market. But the carrier’s market share will expand rapidly as its fleet grows from nine to 50 aircraft over the next four years.

Mr Korfiatis says the carrier projects Citilink will carry 5 million passengers in 2012, 10 million in 2013, 15 million in 2014 and 19 million in 2015. The 2015 projected figure includes 17 to 18 million domestic passengers (the carrier plans to have a small international operation within two to three years) giving Citilink a 17% to 18% share of the domestic market. Even assuming Garuda mainline is not able to meet its goal of increasing its market share and will only be able to maintain its existing share, Garuda and Citilink combined are on pace to have over 40% market share combined by 2015. With Lion expecting 60% market share domestically, that would theoretically leave no room for other carriers.

While some consolidation is likely, it is unfathomable to imagine all airlines outside the Garuda and Lion groups ceasing operations, leaving Lion with a group market share of 60% and Garuda with a group market share of 40%. In 2011, over 20% of Indonesia’s passengers were transported by airlines outside the Garuda and Lion Air groups. This primarily includes Indonesia AirAsia, Batavia, Merpati and Sriwijaya.

Indonesia’s other carriers will not let Lion and Garuda/Citilink take the entire market

Domestically Indonesia AirAsia is the smallest of these four carriers as it is the only carrier in Indonesia with more international than domestic capacity. But Indonesia AirAsia is now seeking to expand its share of the domestic market and proceeds from its upcoming initial public offering (IPO) will give it the capital to accelerate expansion of its A320 fleet, which now includes only 17 aircraft.

Batavia, Merpati and Sriwijaya are almost entirely domestic carriers, each operating about 30 aircraft (Merpati is the smallest among these carriers as a large portion of its fleet consists of small turboprops). Consolidation is likely to come within this group as competition with more powerful Garuda/Citilink, AirAsia and Lion intensifies. But at least one of these carriers will likely survive and continue to capture about a 5% share of the total domestic market.

Further intensifying competition in Indonesia, two new airlines are also expected to enter the market this year with the relaunch of Mandala with new investment from Singapore-based LCC group Tiger Airways and well-funded start-up Pacific Royale. The domestic market is also currently served by several small regional operators.

See related article: Tiger places big bet on Indonesia with re-launch of Mandala

While it is safe to assume the Lion and Garuda groups will control a dominating stake of Indonesia’s traditionally very fragmented domestic market, the duo will almost certainly continue to face competition from at least one or two other carriers on trunk routes and a small group of regional carriers. Collectively these smaller carriers will likely command at least 10% of the total market (assumes some but not total consolidation), down from about 22% currently, making it impossible for Lion and potentially Garuda/Citilink to meet its market share goals.

Mr Kirana tells CAPA his 60% domestic market share goal includes Space Jet, which he says will launch commercial aircraft services in 2013 with 16 of Lion’s 737-900ERs. He expects Space Jet, which will target the top end of the market with a spacious two-class configuration featuring 14 business and 150 economy seats, will eventually operate 60 737-900ERs. (Space Jet also plans to introduce business jet charter services later this year, initially with a fleet of Hawker 900XPs.)

Most of Lion’s current fleet is now in single-class configuration, although a small portion of its fleet is also configured with a business class cabin. These aircraft are typically used for international flights. Lion plans to stop offering business class on Lion-branded flights as Space Jet spools up.

Lion Air could slow down growth by replacing 737-900ERs with 737 MAXs

Lion Air currently operates 57 737-900ERs and prior to the recent order had another 121 737-900ERs on firm order. The new order, which includes 29 additional 737-900ERs and 201 737 MAXs, will give Lion a fleet of 408 737s by 2026. With 60 of these aircraft slotted for Space Jet, Lion’s main low-cost carrier operation will have a projected fleet of 348 737s. An even larger fleet for Lion is possible if the carrier exercises the 150 purchase rights it received as part of its new order. Lion, however, could also slow down growth next decade by replacing a portion of its projected fleet of 207 737-900ERs with the 201 737 MAXs.

Mr Kirana says a decision on whether to use its entire 737 MAX order for growth will be made in about three years and depend on whether full ASEAN open skies is implemented as planned. He believes with open skies Lion will be able to expand its fleet at a pace of 32 aircraft per year. Lion Air is currently taking delivery of 737s at a rate of 24 per year (although the net figure is significantly less this year because the carrier is in the process of phasing out its Boeing MD80/90s). Mr Kirana says its rate of new 737 deliveries is now slated to increase to 32 aircraft per year from 2014.

Open skies will allow Lion to accelerate its expansion in the international market, where it has a relatively small presence, as current bilateral restrictions between Indonesia and the other nine ASEAN countries are lifted. Open skies in ASEAN could also give Lion the flexibility to operate international services outside Indonesia without having to launch new joint venture carriers. Lion previously looked at establishing affiliates in other countries, most recently with a proposed project last year Malaysia’s Berjaya Air which ended up being abandoned. But Mr Kirana says Lion is no longer looking at following the models pioneered by leading Asian groups AirAsia and Jetstar, which have affiliates throughout the region, and “we hope we can put all our aircraft in Indonesia”.

With the 737 MAX, which Boeing says offers 10% to 12% fuel burn improvement over the current generation of 737s in production, Lion also has the flexibility to slow down expansion slightly by opting for the smaller 737-8 MAX. For now all its orders are for the 737-9 MAX, which is the same size of the 737-900ER. Lion will be the first operator of the 737-9 MAX and the first operator in all of Asia for the new 737 MAX family. The historic order was first announced in Nov-2011 but completed and formally signed at this week's Singapore Airshow.

Lion’s Wings Air subsidiary plans rapid growth in regional market

Wings Air is also planning rapid growth to keep up with growing demand for short island-hopping routes in some of Indonesia’s less densely populated regions. Wings Air, which currently bases aircraft throughout Indonesia, says it currently operates 16 ATR 72s, six MD80s and three Bombardier Dash 8s. The carrier expects to eventually operate a fleet of at least 60 ATR 72s while phasing out its Dash 8s. Over the next two years Wings Air also expects to take over 737 Classics from Lion’s fleet while phasing out its MD80s.

Garuda also sees rapid expansion in Indonesia’s regional market, which it expects to tap into with its new order for 18 CRJ1000s. Sriwijaya is similarly targeting the regional market with its planned purchase of 20 E190s. Sriwijaya is expected to attend this week’s Singapore Airshow and discuss firming up its provision order for E190s, which was signed in Jun-2011. Embraer says it continues to work with the carrier on completing the order and expects deliveries will begin in 2013.

See related article: Sriwijaya's ageing fleet gets big boost with E190 order

Mr Korfiatis says Citilink may also later consider acquiring turboprops, pointing out 180 of Indonesia’s airports now have runways which are too small to accommodate narrowbody jets. But he says for now the carrier plans to focus on growing its A320 fleet.

Citilink and Space Jet to also eventually compete in international market

Mr Korfiatas also says Citilink will eventually expand into the international market but not until 2013 at the earliest. He says this year the focus is on adding frequencies to its 10 existing routes and launching five new domestic routes.

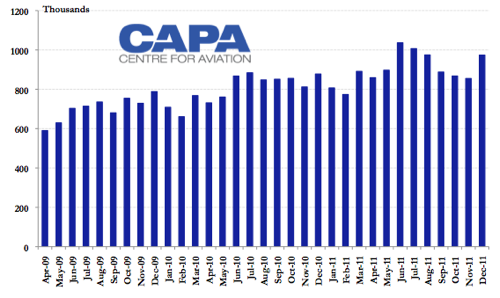

Mr Rusdi says Space Jet will also eventually operate international services using its dual-class 737-900ERs but not until 2014. AirAsia is currently the largest player in Indonesia’s international market, accounting for 28% of total international capacity (seats) to and from the country (this includes a 17% share from Indonesia AirAsia, 10% from AirAsia Malaysia and 1% from Thai AirAsia). Lion Air, which now only has about 6% of its capacity allocated to the international market, currently has a 10% share of Indonesia’s international market while Garuda has a 16% share.

Indonesia’s international market is growing fast but on a much lower base than the domestic market. In 2011, there were only 10.8 million international passengers in Indonesia, a 13% increase over 2010.

Indonesia monthly international traffic (thousands of passengers): Apr-2009 to Dec-2011

AirAsia will look to maintain its leading market share in Indonesia’s international market as the group continues to rapidly expand its A320 fleet. The group has almost 300 additional A320s on order, a large portion of which will be placed into the Indonesian market given the huge potential for growth in Indonesia. Mandala, which plans to relaunch services within the next few months and operate 10 A320s by early 2013, plans to follow a similar strategy to Indonesia AirAsia in allocating most of its capacity to the international market.

Garuda, meanwhile, is also pursuing rapid expansion internationally with large orders for A330s and Boeing 777-300ERs, although many will replace existing older aircraft. There are currently less than 20 widebody aircraft operating in Indonesia, compared to about 280 single-aisle aircraft (excludes aircraft with less than 50 seats). Almost all the expansion will continue to be single-aisle aircraft as the total fleet grows to roughly 800 aircraft over the next 15 years.

Indonesia growth is obtainable but infrastructure challenges must be overcome

While the growth seems astronomical, Indonesia is potentially large enough to support such a large fleet. Airport infrastructure will be a major challenge but the Indonesian Government is starting to finally recognise this issue and is now investing in several major airport upgrade projects. The Government needs to accelerate these investments and start getting ahead of the growth curve as until now it has badly lagged behind.

Keeping up with the growth in Jakarta will particularly be difficult, especially if almost all movements continue to be narrowbody. But a growing chunk of the growth in Indonesia will occur in point-to-point routes that bypass the capital. Indonesia is a huge country and there is or will soon be space to grow in several key provincial centres.

Indonesia has emerged as one of the biggest and most important aviation growth markets. It does not yet typically get mentioned in the same breath as China, Brazil or India. But the recent massive orders have put Indonesia firmly on the map and the industry is starting to notice the huge potential of the Indonesian market.